2021 is a very different year for Vietnam - although the world has suffered a lot from Covid since 2020, it was not until 2021 that Vietnam started to absorb the heaviest effects of the pandemic on all sectors. Since then, there have been rapid and profound shifting trends in agriculture and rural areas.

1. Production Scale

Pillar role in the economy

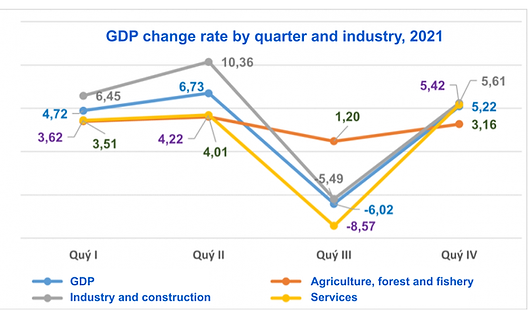

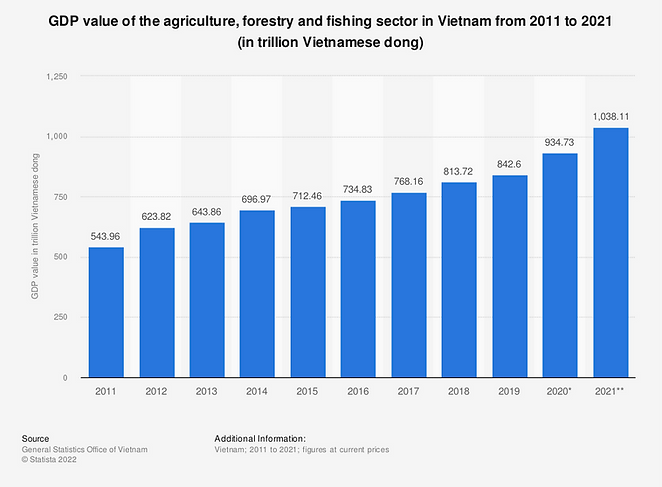

Although many economic sectors were disrupted and suffered heavy damage from social quarantine in 2021, agricultural production was still sustained and even contributed to ensuring social security and national food security, contributing to economic growth.

According to a survey by the Vietnam Chamber of Commerce and Industry (VCCI) branch in Can Tho, during the first nine months of 2021, the whole country had 90.3 thousand enterprises withdrawing from the market, an increase of 15.3% over the same period in 2020. Particularly in the Mekong Delta, during the third quarter of 2021, up to 90% of registered enterprises had to temporarily cease operations, including many agricultural enterprises. Those few businesses that could maintain production through implementing the "three on-site" standard could only operate at 5-10% capacity and with very high costs.

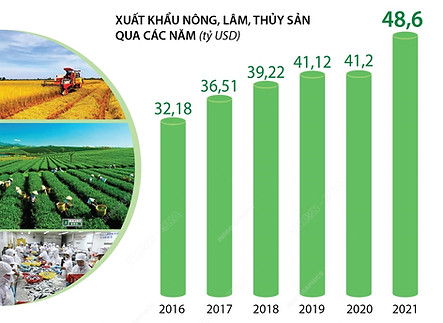

In that context, the export value of agriculture, forestry and fishery in the first 9 months of 2021 still reached 35.5 billion USD, up 17.7% over the same period in 2020. That proves the important role of export processing enterprises.

2. Export Scale

Export sets a record of 48.6 billion USD.

Export turnover in 2021 reached a record high of over 48.6 billion USD. There are 10 groups of products with export turnover of over 1 billion USD each, of which 6 items have a turnover of over 3 billion USD.

.jpg)

The world's supply chain is shifting

Minister of Agriculture and Rural Development Le Minh Hoan emphasized that "In European countries today, many businesses have chosen to import agricultural products from Vietnam instead of only importing from Thailand, South America or Africa as before."

The complicated development of Covid-19 in many countries has motivated many buyers to source from additional vendors to ensure their business continuity. It was the proactive initiatives of Vietnamese enterprises, from production to market, that have brought success to the export of Vietnamese agricultural products.

3. Import Scale

Imports rose to an unprecedented high

The import turnover of agricultural, forestry and fishery products in 11 months is estimated at 39.2 billion USD, up 39% over the same period in 2020.

Vietnam imported a shocking number of rice, cashew and pepper

-

Spending 4 billion USD, Vietnam had a trade deficit with cashew nuts for the first time in more than 30 years. Vietnam exported cashew kernels to the world. A very large amount is imported from Cambodia

-

Vietnam's rice imports from India increased 3,200 times.

-

Import of pepper from Cambodia increased by 111%. Like rice, Vietnam is a country with the top 1 pepper production and export turnover in the world. However, recorded from the Vietnam Pepper Association (VPA), in the first 11 months of 2021, pepper imports from Cambodia increased by 111% over the same period last year.

Some experts in the rice industry said that Indian rice was cheaper than Vietnamese rice, so enterprises took advantage of that to make rice products and feed livestock. Therefore, the amount of imported rice has increased dramatically.

4. Domestic Consumption Scale

GDP value of agriculture: 45 billion USD

The international market for Vietnamese agricultural products continues to grow, and the domestic market is expanding too. Considering that the net export was just around 6 billion USD while total GDP was 45 billion USD, we can see the important contribution of consumption and all domestic value-adding activities to GDP.

Retail sales and dinning services revenue plummeted

79.8% of restaurant, food places and cafe owners said that they not only experienced a decrease in revenue, reduced staff, but many restaurants had to close, close branches, suspend business indefinitely, as shown in a recent survey by SAPO. Retail and food/beverage services are the sectors most affected throughout the year, especially in the third quarter of 2021 when the industry's GDP growth was negative 28.1%. End of 2021, travel services dropped the most (-60%), followed by accommodation and food services (-19%).

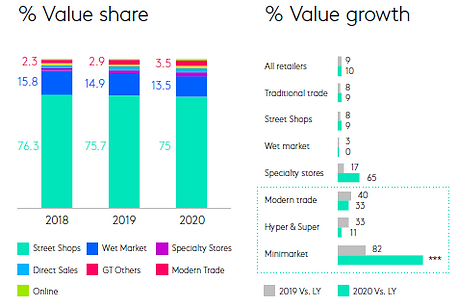

Trend 1: Traditional markets became less popular compared to modern convenience stores.

-

The frequency of people going to the local street market has decreased significantly.

-

Minimarkets and convenience stores have grown tremendously in number and value. New stores pop up everywhere right amid residential areas.

-

As a result, consumers form new habits: they do not need to go to the market but can stay at home, chat with grocery store owners through Zalo chat groups, and then order there. Groceries and food will be delivered to the home and hung on the door, so there is no need for close contact. Attentive customer service like this applies even to chain stores like Vinmart + and Saigon Coop.

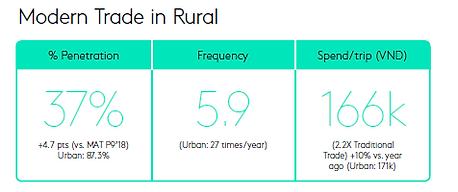

Trend 2: Modern Trade is expanding significantly in Rural

Mini-markets in Rural areas have spend per trip numbers almost as high as in Urban areas. One of the thriving names is Bách Hóa Xanh.

Other trends in Food and Beverage

-

According to Kantar report, health foods have a growth rate of 100%, clean foods have a growth of 94.1% and the line of natural foods without GMOs has a growth rate of 83.3%.

-

Processed food group with high growth includes: Milk and dairy products with a growth rate of 77.2%

-

Ready-to-eat and convenience packaged foods with a growth of 68.4%. The traditional food group, by location, had a growth rate of 58.8%.

-

Fast food group has very low growth and almost unchanged.

5. Number of Businesses, Cooperatives and Workers

New businesses: 1,640

The number of newly established and re-operated enterprises was 1,640, bringing the total number of agricultural enterprises to more than 14,000.

-

It is the growing force of agribusinesses that are getting stronger and more enthusiastic in investing in agriculture and rural development that are becoming the core of Vietnam's agricultural product value chain.

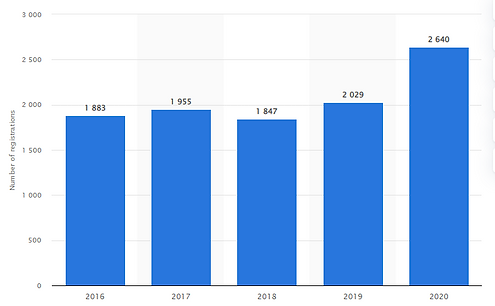

New cooperatives: 1.250

The form of organizing participating entities into production and trading chains in agriculture continues to be innovated. Many linkage models between producers and enterprises and chain cooperatives have been deployed and replicated. In 2021, 1,250 new agricultural cooperatives was established, bringing the total number of agricultural cooperative unions to 19,100. Besides, there are 78 agricultural cooperative unions.

-

There are 4,180 agricultural cooperatives that have partnered with enterprises in production, processing, and consumption of their agricultural products. Along with that, the country has over 30,000 cooperative groups and nearly 19,700 farms.

The program "One Commune One Product" (OCOP) focuses on combining indigenous resources and traditional culture with the application of science and technology, creating diverse, rich and quality products. By the end of 2021, there have been 5,320 OCOP-classified and recognized products, which is an increase of 1.66 times compared to 2020.

Labor force: 28 million people

Overall, the agriculture sector employs the highest share of people in Vietnam. Moreover, the country’s rural population accounted for over 60 percent of the total population.

In 2021, more than 2.2 million people "left city for hometown" due to the Covid-19 pandemic

Due to the complicated development of the 4th Covid-19 epidemic, the underemployment rate in urban areas is higher than in rural areas in 2021. This is contrary to the labor market trend commonly observed in Vietnam. In our country, underemployment is often more serious in rural areas than in urban areas.

Income

Regarding income, according to the General Statistics Office, by the end of 2021, the average monthly income of employees is 5.7 million VND, down 32 thousand VND compared to 2020. In terms of economic sector, compared with 2020, labor in the agriculture, forestry and fishery sectors maintained a stable positive growth rate, with an average monthly income of 3.6 million VND in 2021. increased by 7.1%, equivalent to an increase of 236 thousand VND.