1. Production and Processing Scale

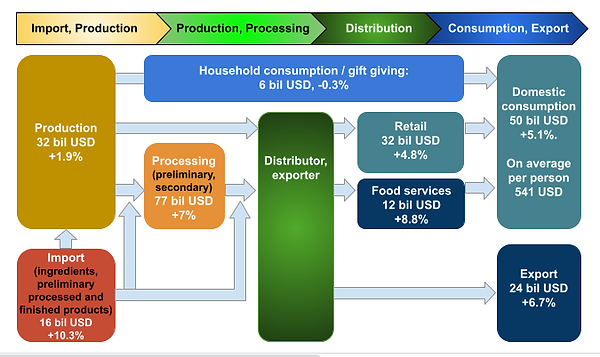

The annual value of agricultural production reaches 32 billion USD. Import value of food and agriculture products is about 16 billion USD.

Processing and exporting value of food and agricultural products reached 77 billion USD. The average growth rate reached 7.0% in the last 5 years (2013-2017).

The domestic food market in the next 5 years (2020-2025) is estimated to increase by 30%, reaching $83 billion. Import and export of agricultural products is also expected to increase.

2. Consumption Scale

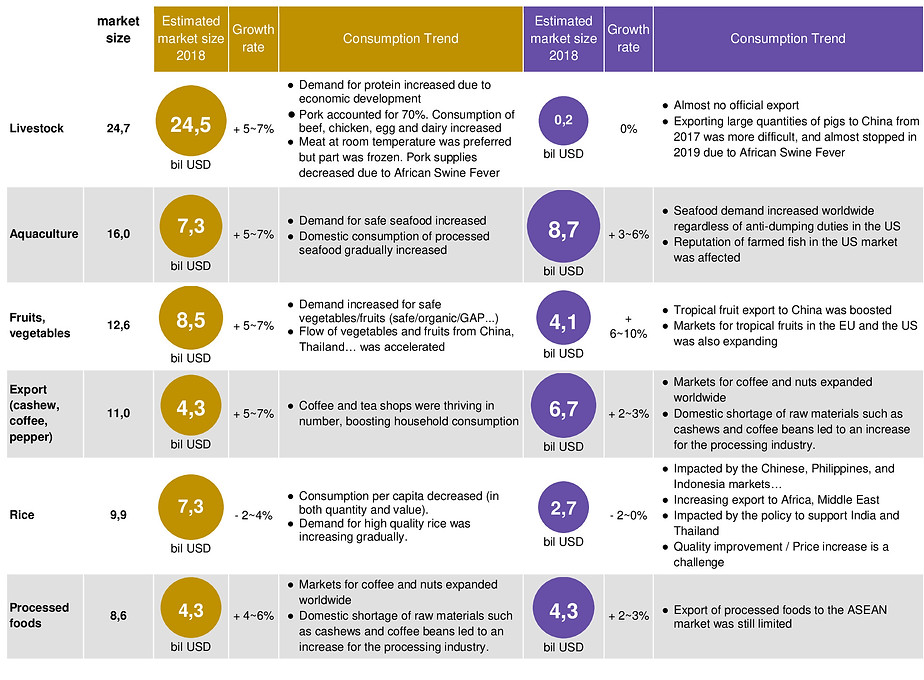

The estimated size of the domestic market is 56 billion USD (2018), the international market size is estimated to reach 27 billion USD (2018).

The retail market accounts for about 95%, mainly traditional retail (fresh markets, toad markets, private retailers). There are 8,475 markets, 660,000 wholesale and retail stores.

Modern retail accounts for 5% (57% supermarkets, 35% hypermarkets, 8 percent convenience stores), total supermarkets ~1,000.

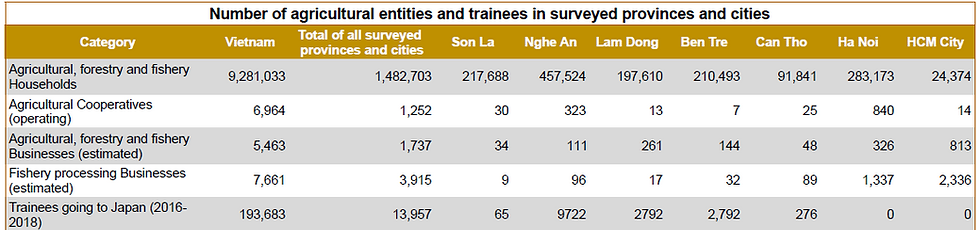

3. Number of Vietnamese Businesses and Labors in Agriculture

Vietnam has 9,280 thousand agricultural households, 13,171 agricultural extension organizations (of which 18% are in the form of FVC).

The number of companies in the agricultural sector, FVC is estimated at 5,643 companies, in the food processing sector at 7,661 companies.

The number of trainees to Japan is 193,683 (2016 - 2018), of which it is estimated at 150,000 people in agriculture, forestry and fishery (2018). However, the number of people returning home still working in agriculture, forestry and fishery is very small, mainly working in the service industry and non-agricultural production.

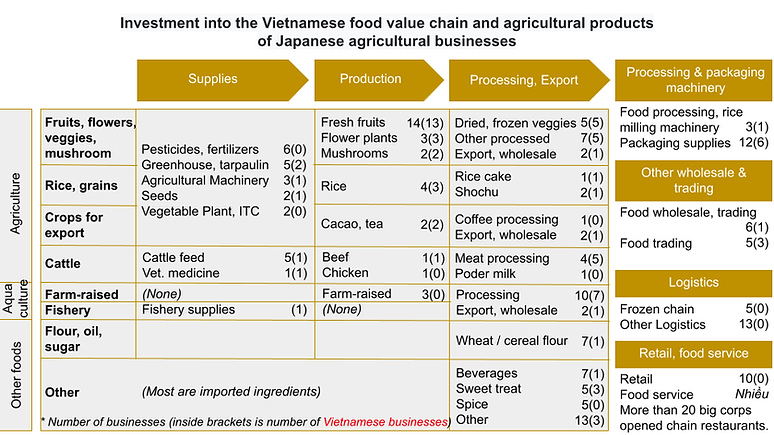

4. Number of Japanese Businesses Investing in the Vietnamese Agriculture

The number of Japanese enterprises in the field of agriculture and value chains (FVC) is 200 companies (as of 2019, excluding representative offices). Of which 36% (72 units) are small and medium enterprises. They are mainly concentrated in the city. Ho Chi Minh City, Hanoi and surrounding areas, Lam Dong, Da Nang, operating in the fields of agricultural machinery and materials, fruit and vegetable production, and seafood processing.

Challenges when implementing business:

1) Securing human resources;

2) Logistics system, goods circulation (infrastructure);

3) Legal regulations (central and local administrative procedures). In addition, problems such as residues of pesticides, food safety, assurance of agricultural land, assurance of local partners... are also very serious.

5. Policies of the Vietnamese Government for Investors

The Vietnamese government encourages foreign investors to invest in the food value chain, applying many preferential policies such as corporate income tax exemption, import tax exemption, tax exemption or free use. land, water surface, VAT exemption, equipment and machinery subsidies, preferential interest rates for bank loans...

1 - ENCOURAGED INVESTMENT FIELDS

-

Very difficult socio-economic areas (especially difficult areas)

-

Economic zones

-

High-tech zones

-

Industrial zones

2 - WAIVED OR DISCOUNTED LAND OR WATER SURFACE RENT

-

Encouraged or incentivized investment projects: at least 5 years of favorable price.

-

Specially incentivized investment projects: free rent.

-

Incentivized investment projects: 15 years free rent, next 7 years 50% off.

-

Encouraged investment projects: free rent for 11 years, 50% reduction for the next 5 years.

-

Housing for workers or for non-agricultural purposes: free land rental.

-

Newly established small and medium enterprises: free rent for 5 years, 50% reduction for the next 10 years.

3 - WAIVED OR REDUCED CORPORATE INCOME TAX

-

Enterprises with new investment projects in particularly difficult areas, economic zones, or high-tech zones.

-

High tech enterprises and high tech agricultural enterprises their corporate income tax waived for the first 4 years, and reduced by 50% for the next 5 years.

4 - WAIVING IMPORT TAX

-

Import tax exemption for goods that are fixed assets subject to investment incentives.

-

Tax exemption for the next 5 years for goods being raw materials, supplies and components.

-

Raw materials, supplies and components that cannot be produced domestically, imported by high-tech enterprises, science and technology enterprises, or science and technology organizations in the fields and lists of trade and investment eligible for special incentives, or serving production activities in areas with special difficulties specified in the Law on Investment, will be exempt from import tax for 5 years from the date of production start.

-

Exemption from tax on plant varieties, animal breeds, fertilizers and pesticides.

-

Plant varieties, animal breeds, fertilizers and plant protection drugs that cannot be domestically produced or imported to directly serve agricultural, forestry and fishery production are exempt from import tax.

5 - INVESTMENT SUPPORT

SUPPORT FOR INVESTMENT IN MACHINERY PRODUCTS FOR AGRICULTURE AND RURAL DEVELOPMENT, AGRICULTURE MACHINERY, COMPONENTS, ACCESSORIES

Support 60% of the total investment cost, and the maximum is 10 billion VND/project.

Attention: There are many laws, regulations, rules about investing, and are subject to change, so pay attention

Source:

-

Decree 134/2016/ND-CP detailing a number of articles and measures to implement the Law on Import and Export Tax.

-

Decree 57/2018/ND-CP On mechanisms and policies to encourage enterprises to invest in agriculture and rural areas.

-

Decision No. 176/QD-BCT dated January 28, 2019 of the Ministry of Industry and Trade promulgating the List of manufactured mechanical products, components, agricultural machines and auxiliary products for agricultural and rural development approved for investment support.